|

| One of these things is not like the other... |

First allow me to say thanks to CL for letting me post a few thoughts here. Also, I wish to thank those of you who took the time to read my previous posts. One of those posts, 'Federal Income Tax Disparity' generated a comment from a person named 'Rick W'. Here is the entire comment:

The premise of this article is false and the charts are meaningless. The "percentage of total revenue" paid by any individual or group across the income spectrum cannot provide any sense of fairness or inequality unless the "percentage of total income" is part of the calculus.

But let's accept your unsupported premise that the tax system is unfair. We should therefore expect to see unfair outcomes. If the wealthy are contributing too high a percentage, as you claim, then certainly their income and net worth are falling as a result.

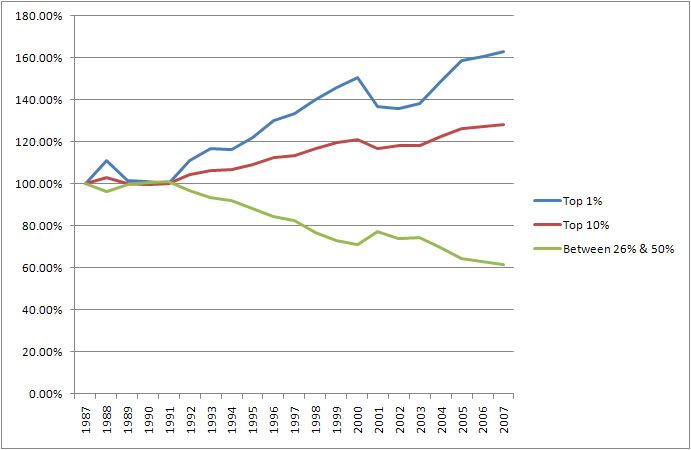

In reality the, of course, after-tax incomes of the top 10% have grown far faster than those of the bottom 90%. Between '02 and '07 the income of the top 1% grew 1000% faster than the bottom 90%. Net worth has also grown dramatically.

Asserting that individuals should contribute even percentages of their incomes to the national budget is absurd. First, that presumes the economy provides a perfect measure of an individual's effort and ability by delivering fair and proportional incomes, which is obviously not the case. Second, it presumes there is no value to society helping the less fortunate.

A fair tax system must take into account the degree to which the tax burden will impact the lives of the tax payer. A ten percent tax bill for someone earning $10k will have a much more significant impact than a thirty percent bill to a person earning $250k. Yes, $75k is a lot of money to pay in taxes. But it's a whole lot easier to live on $175k than on $9k.

I initially was going to respond to Rick in the comments, but decided that the charts I wished to publish would not show up in the comments. Voila, new post. Let's address Rick's concerns one at a time.

The premise of this article is false and the charts are meaningless. The "percentage of total revenue" paid by any individual or group across the income spectrum cannot provide any sense of fairness or inequality unless the "percentage of total income" is part of the calculus.The premise of the article is that there are disparities between the tax rates individuals pay based upon income level; increasing numbers of Americans who effectively do not pay income tax; a fair tax and entitlement reform would decrease the number of households who do not pay income tax.

But let's accept your unsupported premise that the tax system is unfair. We should therefore expect to see unfair outcomes. If the wealthy are contributing too high a percentage, as you claim, then certainly their income and net worth are falling as a result.

The first section of the post shows how the overall percentage of tax revenue generated by the top 1% and 10% of earners has increased since 1987 and the percentage of tax revenue generated by the 26-50% group has fallen. I did not claim, as Rick suggests, that this indicates some sort of inequality. However, since he's brought it up, let's take a look at some unfairness.

Below are two charts. The first chart represents the Top 1% of wage earners in the United States. It shows their adjusted gross income in dollars, the tax revenue generated from this group, and the average tax rate percentage.

The second chart represents the 26-50% of wage earners group. It depicts adjusted gross income in dollars, the tax revenue generated by this group and the average tax rate percentage.

In 1999, 2000 and 2004 these two classes adjusted gross income were roughly the same as a group. In 1999 the AGI for each group was approximately $1.175 Trillion; in 2000 the AGI was $1.30 Trillion for each; in 2004 the AGI was $1.356 Trillion for each. However, the rate at which these AGI's were taxed is radically different. Why? One group's AGI was taxed at just a little over 26% and the others was taxed at 8.5%. One group paid an average of $330 billion in taxes while the other group paid an average of $108 billion. Same rough AGI, same earning peroid, same country. The only difference was the number of earners in each group, 1.28 million in one group and 32 million in the other. The top 1% of wage earners are taxed at a higher percentage because... they can handle the tax burden? What?! This thinking amounts to a penalization upon those who do well and succeed. We can argue all day long about who is in each tax bracket, and how they got there, but the reality is that a majority in each tax bracket would argue that they work hard to earn their income.

This is the unfair outcome, wealth is confiscated at a much higher rate from the wealthy than it is from the middle class.

Now on to Rick's second point.

Asserting that individuals should contribute even percentages of their incomes to the national budget is absurd. First, that presumes the economy provides a perfect measure of an individual's effort and ability by delivering fair and proportional incomes, which is obviously not the case. Second, it presumes there is no value to society helping the less fortunate.No one 'asserted' that 'individuals should contribute even percentages of their income to the national budget'. The Fair Tax taxes consumption, not production. From Americans For Fair Taxation's FAQ page:

A fair tax system must take into account the degree to which the tax burden will impact the lives of the tax payer. A ten percent tax bill for someone earning $10k will have a much more significant impact than a thirty percent bill to a person earning $250k. Yes, $75k is a lot of money to pay in taxes. But it's a whole lot easier to live on $175k than on $9k.

What is taxed?Therefore, the Fair Tax does accurately measure an individuals effort, the effort to spend.

The FairTax is a single-rate, federal retail sales tax collected only once, at the final point of purchase of new goods and services for personal consumption. Used items are not taxed. Business-to-business purchases for the production of goods and services are not taxed. A rebate makes the effective rate progressive.

The broader implication seems to be that the current 'progressive income tax' does a good job of measuring individual effort and ability. Such an assertion is ludicrous. You might suggest that the tiered tax rates are that measurement, but that's ridiculous as any family with and AGI of $114,000 will tell you. A family with an AGI of $114,000 in 2007 was taxed at 12.66% on average. However, a family with an AGI of $112,000 was only taxed at 9.43% on average. The implication that the progressive tax effectively measures individual effort then states that the family with the AGI of $112,000 worked harder than the family with an AGI of $114,000.

The Fair Tax does a good job of solving some of the inherent problems within our 'progressive tax system', and it places an incentive upon activities which grow the economy. To find out more about the Fair Tax, visit Americans for Fair Taxation.

Please take the time to comment! Click the Informed Opinion Link adjacent to the Post Title.