|

| The result of out of control government spending coupled with diminishing numbers of federal income tax payers. |

In a report released on July 30, 2009, The Tax Foundation detailed the Federal Individual Income Tax Data. In the report are several interesting statistics, but when coupled with an article written by The Tax Foundation's Scott A. Hodge, those same statistics become quite alarming. Amongst the data contained in the reports is the revelation that the disparity between households which pay federal income tax and those that do not is growing, unsustainably.

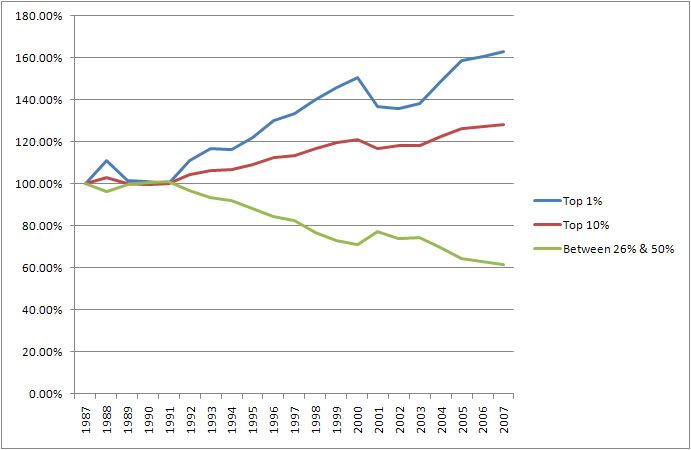

First let's break down the remarkable federal income tax numbers. During the period from 1987 to 2007 (the most recent federal income tax data available), the percentage of total tax dollars paid in by the top 1% of earners shot up more than 62% from 24.81% to 40.42%. The percentage paid by the top 10% of wage earners during the same period has increased from 55.61% to 71.22%. Meanwhile, the federal income tax percentage paid by the top 26% to 50% of wage earners (those making between $32,879 and $66,532) has fallen from 17.02% to 10.52%.

|

| Percentage Paid by Group |

|

| Percentage Increase/Decrease by Group |

We've all seen someone who brings a small salad to the potluck but piles lots of your casserole on his plate. Or, there is always one person in the lunch group who orders the most expensive meal on the menu because she knows you are all splitting the check.Indeed the top 26%-50% of federal income tax payers (those who earn between $32,879 and $66,532) pay a mere 10.52% of the total federal income tax revenue. Theoretically, this group is also the second most likely to utilize support from federal entitlement programs. Sadly, the direction in Washington does not appear to be headed toward righting the problem before us. Hodge continues:

The same thing happens with government. A growing number of Americans are contributing little but taking a lot, and a shrinking number are giving a lot but taking little.

Recent IRS data for 2008 reports that a record 52 million Americans—or 36% of all filers—filed a tax return but had no income tax liability because of the generosity of the credits and deductions that have been enacted over the past 15 years.

The tax code has always had exemptions to protect the poorest Americans from paying income taxes, but the new credits—such as the child tax credit, Making Work Pay credit, and First Time Homebuyer credit—are now exempting middle-class families from the income tax.

Remarkably, a family of four earning up to $52,000 can expect to pay no income taxes because of these various tax credits. That too is a record.

Many more of these taxpayers are now getting checks back from the IRS even though they pay no income taxes. The IRS paid out $70 billion in "refundable" checks to non-payers in 2008. In essence, lawmakers have turned the IRS into an ATM machine for welfare benefits—and ATM now stands for Another Taxpayer's Money.

Sadly, millions of people now see April 15 as payday, not tax day.

President Obama's policies, from health care to taxes, are all intended to increase the number of takers in America while reducing the number of givers. Our analysis of Obama's FY 2011 budget plan shows that it would increase the amount of redistribution from the top 10% of families by nearly $100 billion per year—to a total of $854 billion—while expanding the amount of government benefits targeted to the middle and upper-middle classes.

Economists have identified a phenomenon they call "fiscal illusion." When people perceive the cost of government is less than what it really is, they will demand ever more government. The real danger today is not just that we have so many non-payers, but that the $1.5 trillion deficit is making the cost of government look cheap for all of us. So much spending is raining down on us that it now seems like "free money" in a sense.

Every marketing guru will tell you that people love free stuff and that they will take as much as they can get whether they need it or not. But for a nation, this is a recipe for fiscal disaster.

This constitutes one of the most major of flaws inherent in the 'progressive income tax.' A progressive tax system is, by definition, not fair. Groups within the tax system are penalized by the fact that they are a member of a specified group. This creates the incentive to 'game' or cheat the system. Looking at our current tax system, if you are in the top 1% of wage earners, and you can find a way to represent your earnings as being within the top 2-5% of wage earners, you can take 22% off the amount you would have paid. At an income of $410,096 that means more than $20,000 in tax money that would otherwise be paid into the federal tax system which is instead in your pocket. Think there's an incentive to cheat?

The increasing discrepancy between the numbers who pay federal income tax those who do not is one of the strongest arguments for a fair tax. The most popular of these would be levied in the form of a national sales tax. Every transaction, taxed at the federally required 23%. A recent article at National Review Online by Ramesh Ponnuru entitled, "A Misleading Sales Pitch" argued that the proposed 23% tax would not be enough:

It is not at all clear that this [23] percent sales tax would raise enough revenue to eliminate income and payroll taxes. Brookings Institution economist William Gale has estimated that to replace current federal tax revenues, the tax rate would have to be 44 percent...The piece is not so much a damaging blow against the advocacy for a fair tax, as it is an indictment of the cost of entitlement programs. Americans for Fair Tax Reform has a point by point rebuttal of Mr. Ponnuru's more serious charges.

A fair tax coupled with true entitlement reform would correct the imbalance in federal income tax payers and serve to reduce bloat in federal government at the same time. True tax reform is desperately needed, and unless someone appears on the political scene who can put aside personal ambition in favor of reforming our current system, our economic future is sealed and the greatest human experiment is destined for the trash heap.

Please take the time to comment! Click the Informed Opinion Link adjacent to the Post Title.

5 People Have Had Their Say:

The premise of this article is false and the charts are meaningless. The "percentage of total revenue" paid by any individual or group across the income spectrum cannot provide any sense of fairness or inequality unless the "percentage of total income" is part of the calculus.

But let's accept your unsupported premise that the tax system is unfair. We should therefore expect to see unfair outcomes. If the wealthy are contributing too high a percentage, as you claim, then certainly their income and net worth are falling as a result.

In reality the, of course, after-tax incomes of the top 10% have grown far faster than those of the bottom 90%. Between '02 and '07 the income of the top 1% grew 1000% faster than the bottom 90%. Net worth has also grown dramatically.

Asserting that individuals should contribute even percentages of their incomes to the national budget is absurd. First, that presumes the economy provides a perfect measure of an individual's effort and ability by delivering fair and proportional incomes, which is obviously not the case. Second, it presumes there is no value to society helping the less fortunate.

A fair tax system must take into account the degree to which the tax burden will impact the lives of the tax payer. A ten percent tax bill for someone earning $10k will have a much more significant impact than a thirty percent bill to a person earning $250k. Yes, $75k is a lot of money to pay in taxes. But it's a whole lot easier to live on $175k than on $9k.

Rick,

Thanks for stopping by and commenting. I am going to let JB answer you, but I appreciate your willingness to read and comment. I do, however, have a question.

You said:

"The "percentage of total revenue" paid by any individual or group across the income spectrum cannot provide any sense of fairness or inequality unless the "percentage of total income" is part of the calculus."

I may be mistaken here, but isn't FICA tax levied as a "percentage of total income?" Therefore it's inherent in the calculus?

You miss my point.

You could say that Group A paid 90% of the total taxes, and Group B paid only 10% -- that's unfair! But, unless I know the percentage of total income that Groups A & B earned, your claim can't be verified. Did group A earn more than, less than, or exactly 90% of the income? Based on the answer, it could be unfair to A, fair, or even unfair to B. What if Group A earned 98% of all the income?

Your last sentence gives me pause. You are aware that FICA is *not* income tax, and is therefore not related to your article or our discussion, aren't you? But even assuming that was just a typo, the answer is still "No." The calculus of your argument is incomplete without the percent-of-total-income figure.

Just got in from a week of traveling. Thanks for the comment Rick. My response will be long and quite detailed with some additional charts. Therefore it will have to go up as a blog post. CL tells me that blog traffic on the weekend sucks, so expect to see it Monday morning early.

Have a great weekend everybody!

I too read a problem with this article ...

The writer goes out of his way to isolate those between the lower 26% and the 50% mark but includes the top 1% with the top 10%. If we called the lower 26% the top 75% we'd have a different result altogether.

So, doing the math, what we see is that the top 1% started in '87 contributing 24.81% of the income tax burden while the top 10% (inclusive of the top 1%) contributed 55.61% ... this means that those in the top 91% to 99% range accounted for 30.80% of the burden. (55.61 - 24.81 = 30.80)

In '97 the top 1% contributed 40.42% and the top 10% paid 71.22%. Again, those between 91% and 99% paid 30.80% of the burden. SO for 90% of the top 10% of earners, during the period examined, there was zero increase at all.

The approach taken by the author seems as manipulative as does not including mobility of earnings when drawing these pictures as Rick W pointed out.

Post a Comment